Marginal Tax Rates Australia

Taxes taxing meep governor stump brackets cbs Tax marginal average vs rates Historical tax rates on the rich (1862 to 2011)

Historical Tax Rates on the Rich (1862 to 2011) | Bud Meyers

Tax marginal rates rate history definition brackets study Economists say we should tax the rich at 90 percent Marginal vs. average tax rates

The missing $1,000,000 tax bracket

Stump » articles » taxing tuesday: the governor of illinois talks taxesTax marginal rate rates top bracket raising income graph over time higher missing will history why fivethirtyeight should truly policy Tax australian government treasury taxes revenue composition gov au cent federal glance through sum percentages note per mayTax rate top marginal 90 percent income rich should rates chart say taxes economists bracket federal taxprof post reaganomics highest.

Graphs for democrats: top marginal us tax rates (1913Marginal retirees poor 65s Policy basics: marginal and average tax ratesRates effective provinces tax across marginal income low high.

Marginal taxpayer thresholds parliamentary parliament library levy repair

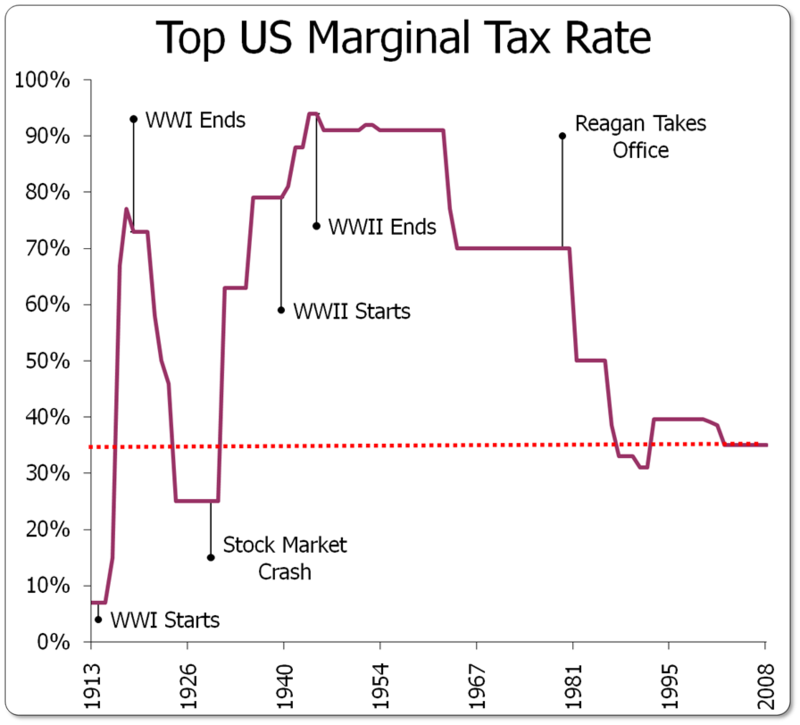

Tax marginal rates top 2008 1913 rate taxes graph income chart over graphs economic fiscal term such thing long thereMarginal tax rates in the united states Marginal individuals treasuryIncome tax rates 2010-2011 australia – australian information.

At a glanceTemporary budget repair levy – parliament of australia Yes, poor retirees pay higher effective marginal tax rates than theMarginal effective tax rates across provinces: high rates on low income.

Tax australia rates ato income 2011 australian 2010 tables weekly 2009 withholding chart

Marginal basics taxationRanges income specific over tax rates effective marginal whiteford wales policy peter centre research australia social university south Tax rates income marginal chart corporate rate top historical taxes capital gains since rich 1916 2010 years eisenhower history president.

.